Page 12 - Rolls Royce, Bentley Mihi Exculta Magazine (Made for Me) - Issue 2, designed and produced by Connell Marketing Associates, UK

P. 12

MARKETS LUXURY of the Data

SECTOR

Rolls-Royce and Bentley’s FACTS HLS data is critical in establishing

share of the world high market potential for individual

luxury sector (HLS) continues increase in share, dealers as well as bench-marking

to rise. performance, dealer to dealer. Not

but not everywhere only is there a variation in share

Rolls-Royce and Bentley has out- performance market to market, but

performed all other marques in the the performance between dealers

HLS (in those markets where HLS within in a single market can be

data exists), with retail registrations dramatic.

up 26% year-on-year to deliver a year-

to-date HLS share of 3.4%, compared The table (C) graphically demon-

with 2.6% at the same point in 1996. strates the range of Rolls-Royce and

Bentley shares across the 16 markets

The world HLS is currently run- where data exists.

ning 1% down on the ’96 level but is

forecast to recover to a full year vol- As we begin to establish indi-

ume of 55,000 units, 500 units vidual dealer market size and mar-

ahead of 1996. ket share performance, it is clear that

some dealers are out-performing

The four largest HLS markets in

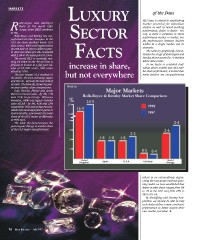

the world - the USA, Germany, Japan TABLE (A)

and the UK - account for over 80% of

its total. The table (A) shows the year-

on-year market share comparisons.

Only Porsche, Ferrari and Aston

Martin increased sales - by 4%, 11%

and 25% respectively. Whereas

Mercedes, BMW and Jaguar Daimler

sales all fell - by 8%, 42% and 55%

respectively. This means that Porsche,

which has made significant gains in

recent months, now boasts the same

share of the HLS sector as Mercedes

at 40% each.

The table (B) demonstrates the

year-on-year change in market share

of the HLS major manufacturers.

The Importance

others to an extraordinary degree.

Using the new dealer business plan-

ning model, we have established that

dealer market share ranges from 9%

to 1% in the USA and from 23% to

8% in the UK.

By identifying and sharing best-

practice, we should be able to help

each dealer deliver a more consistent

performance to better exploit their

own market potential. ❖

12 MIHI EXCULTA - July 1997