Page 39 - Ickford NP Background Evidence

P. 39

ICKFORD NEIGHBOURHOOD PLAN : BACKGROUND EVIDENCE REPORT 39

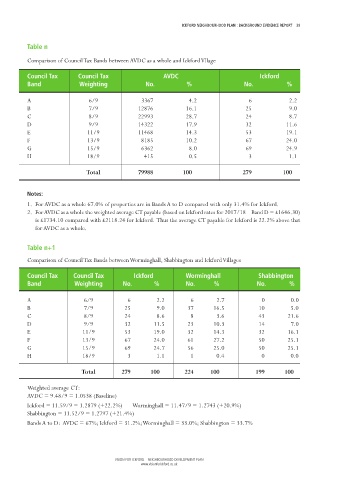

Table n

Comparison of Council Tax Bands between AVDC as a whole and Ickford Vllage

Council Tax Council Tax AVDC Ickford

Band Weighting No. % No. %

A 6/9 3367 4.2 6 2.2

B 7/9 12876 16.1 25 9.0

C 8/9 22993 28.7 24 8.7

D 9/9 14322 17.9 32 11.6

E 11/9 11468 14.3 53 19.1

F 13/9 8185 10.2 67 24.0

G 15/9 6362 8.0 69 24.9

H 18/9 415 0.5 3 1.1

Total 79988 100 279 100

Notes:

1. For AVDC as a whole 67.0% of properties are in Bands A to D compared with only 31.4% for Ickford.

2. For AVDC as a whole the weighted average CT payable (based on Ickford rates for 2017/18 – Band D = £1646.30)

is £1734.10 compared with £2118.24 for Ickford. Thus the average CT payable for Ickford is 22.2% above that

for AVDC as a whole.

Table n+1

Comparison of Council Tax Bands between Worminghall, Shabbington and Ickford Villages

Council Tax Council Tax Ickford Worminghall Shabbington

Band Weighting No. % No. % No. %

A 6/9 6 2.2 6 2.7 0 0.0

B 7/9 25 9.0 37 16.5 10 5.0

C 8/9 24 8.6 8 3.6 43 21.6

D 9/9 32 11.5 23 10.3 14 7.0

E 11/9 53 19.0 32 14.3 32 16.1

F 13/9 67 24.0 61 27.2 50 25.1

G 15/9 69 24.7 56 25.0 50 25.1

H 18/9 3 1.1 1 0.4 0 0.0

Total 279 100 224 100 199 100

Weighted average CT:

AVDC = 9.48/9 = 1.0538 (Baseline)

Ickford = 11.59/9 = 1.2879 (+22.2%) Worminghall = 11.47/9 = 1.2743 (+20.9%)

Shabbington = 11.52/9 = 1.2797 (+21.4%)

Bands A to D: AVDC = 67%; Ickford = 31.2%; Worminghall = 33.0%; Shabbington = 33.7%

VISION FOR ICKFORD – NEIGHBOURHOOD DEVELOPMENT PLAN

www.visionforickford.co.uk